Stock Market Crash or Boom? Expert Predictions and Market Forecast Analysis 2026

Will 2026 bring a stock market crash or boom? Explore expert predictions, Global Stock Market trends, risks, opportunities, and smart investment strategies for the year

The Global Stock Market is once again at a turning point. Investors around the world are asking the same question: will 2026 bring a crash or a boom in the stock market?

The stock market has always moved in cycles. Prices rise, then they fall, and then they rise again. Understanding these patterns can help you make smarter decisions in the stock market.

In this article, we will break down expert predictions, market trends, risks, and opportunities. You will learn what may shape the stock market in 2026 and how to prepare.

How the Market Moves?

The stock market does not move randomly. It reacts to real events like economic growth, company profits, interest rates, and global news.

When businesses earn more money, the stock market often rises. When fear spreads, investors sell shares, and the stock market may fall.

For example, during past economic slowdowns, prices dropped fast. But after recovery plans were introduced, the stock market bounced back stronger.

Key Factors That May Shape 2026

Many experts believe several forces will shape the stock market in 2026. These forces are already building today.

Here are the most important ones:

- Interest rate changes by central banks

- Inflation levels in major economies

- Corporate earnings growth

- Political stability in large countries

- New technology breakthroughs

- Energy prices and supply chains

If inflation remains under control, the stock market could see steady growth. But if rates rise too quickly, pressure may build.

Global Stock Market Outlook for 2026

The Global Stock Market is deeply connected across countries. A slowdown in one major economy can quickly affect others.

Experts predict moderate growth in the Global Stock Market if economic conditions stay stable. Emerging markets may grow faster than developed markets.

However, risks remain. Trade tensions, wars, or sudden policy changes can create sharp drops in the Global Stock Market.

Some analysts believe Asia and parts of Europe could lead gains. The United States is expected to remain strong but may grow at a slower pace.

Could a Crash Really Happen?

A crash in the stock market usually happens when fear spreads quickly. Investors rush to sell, and prices fall sharply in a short time.

Crashes are often triggered by:

- A financial crisis

- Sudden economic recession

- High levels of debt

- Major geopolitical conflict

While experts warn about possible corrections, most do not expect a severe crash in 2026. Instead, many predict short-term volatility within the stock market.

Volatility means prices move up and down quickly. This can feel scary, but it is normal in the stock market.

Signs That Point Toward a Boom

A boom happens when confidence grows. Investors feel safe putting money into the stock market.

Here are signs that could lead to a boom in 2026:

- Strong job growth

- Rising consumer spending

- Innovation in artificial intelligence

- Stable interest rates

- Strong corporate profits

Technology companies, especially those focused on artificial intelligence and green energy, are expected to lead growth in the stock market.

If companies continue reporting solid earnings, the stock market could reach new highs.

The Role of Artificial Intelligence in Market Growth

Artificial intelligence is changing the stock market in powerful ways. Many companies are using AI to improve efficiency and cut costs.

Investors are also using AI tools to analyze trends in the Global Stock Market. This helps them make faster decisions.

In 2026, AI-driven industries may become a major force behind stock market growth. However, hype can also create bubbles.

When prices rise too fast due to excitement, corrections may follow. So balance is important in the stock market.

Interest Rates and Inflation Impact

Interest rates have a direct effect on the stock market. When rates are low, borrowing is cheaper, and companies can expand.

When rates rise, businesses face higher costs. This can slow growth in the stock market.

Inflation also plays a key role. If inflation stays under control in 2026, the stock market may remain stable.

But if inflation rises again, central banks may increase rates. That could create pressure on the Global Stock Market.

Investor Sentiment and Market Psychology

The stock market is driven by emotion as much as data. Fear and greed often shape price movements.

When news is positive, investors rush in. When bad news appears, panic selling can push the stock market lower.

Social media now spreads information quickly. This can increase volatility in the stock market.

Experts suggest staying calm during market swings. Long-term investors often benefit by avoiding emotional decisions.

Risks Investors Should Watch

Even if forecasts look positive, risks remain. The stock market always carries uncertainty.

Here are key risks for 2026:

- Global debt levels

- Banking system stress

- Unexpected economic slowdown

- Political instability

- Cybersecurity threats

The Global Stock Market could react strongly to sudden shocks. Diversifying investments can reduce risk.

Diversification means spreading money across different sectors and regions in the stock market.

Opportunities in Different Sectors

Certain sectors may outperform in 2026. Analysts point to technology, healthcare, renewable energy, and infrastructure.

For example, green energy

companies may grow as governments push clean policies. Healthcare may expand due to aging populations.

Small-cap stocks could also offer growth opportunities in the stock market. However, they carry higher risk.

Investors who research carefully may find strong returns in specific areas of the stock market.

Long-Term vs Short-Term Strategy

Some investors focus on short-term gains. Others invest for the long term in the stock market.

Short-term trading can bring quick profits. But it also carries high risk.

Long-term investing often provides steadier growth in the stock market. History shows that markets tend to rise over decades despite temporary drops.

Experts often suggest:

- Invest regularly

- Avoid panic selling

- Focus on strong companies

- Rebalance your portfolio yearly

Patience has rewarded many investors in the stock market.

What Experts Are Predicting for 2026?

Most financial analysts expect moderate growth in the Global Stock Market in 2026. Growth may not be explosive, but steady progress is expected.

Some predict returns between 6% and 10% if economic conditions stay stable. Others warn about possible corrections of 10% to 15% during the year.

This means 2026 could bring both opportunities and temporary drops in the stock market.

Smart investors prepare for both scenarios. Planning ahead reduces fear during market swings.

Final Thoughts

So, will 2026 bring a crash or a boom in the stock market? The honest answer is that no one knows for sure.

The Global Stock Market shows

signs of steady growth, but risks remain. Economic trends, interest rates, technology, and global events will shape the outcome.

Instead of trying to predict every move in the stock market, focus on building a balanced strategy. Study trends, stay informed, and think long term.

Top Stocks Based on People’s Search Data: Trending Market Opportunities

Discover Top Stocks based on people’s search data and uncover trending market opportunities. Explore the Best Stock Picks across tech, healthcare, energy, and more to make smarter investment decisions.

Investors are always looking for Best Stock Picks that match market trends and public interest. One smart way to spot Top Stocks is by studying what people are searching for online and where their attention is going.

Search data gives us clues about which companies are gaining buzz. When many people search for a stock, it often means something big is happening around it.

In this article, we will explore how search trends can help identify Top Stocks, why public interest matters, and which sectors are currently leading the market.

Why Search Data Matters in the Stock Market

Search engines show what people care about. When thousands search for a company, it often signals growing interest.

This attention can come from news, earnings reports, or new product launches. In many cases, search spikes happen before stock prices move.

For example:

- A tech company launches a new device.

- News spreads quickly online.

- People start searching for the company.

- Investors notice and begin buying shares.

This chain reaction can turn a regular stock into one of the Top Stocks in the market.

How Public Interest Shapes Stock Trends

People’s search habits reflect emotions like fear, hope, and excitement. These emotions often drive buying and selling decisions.

When investors feel confident, they search for growth companies. When they feel worried, they search for safer stocks.

Here’s how public interest influences markets:

- Increased searches can mean rising demand.

- Viral news can boost trading activity.

- Social media discussions can push prices higher.

By watching these signals, investors can find early hints about potential Top Stocks.

Technology Sector Leaders

Technology companies often dominate search trends. New tools, apps, and devices create excitement.

Stocks in this sector frequently appear among the Top Stocks because innovation attracts attention.

Some reasons tech stocks trend:

- Product launches.

- Artificial intelligence updates.

- Cloud computing growth.

- Strong earnings reports.

When search data rises for major tech brands, investors often follow closely.

Healthcare Companies Gaining Attention

Healthcare stocks also see strong search interest, especially during medical breakthroughs.

When a company announces a new drug or treatment, online searches can surge overnight.

This makes healthcare one of the most watched areas for Top Stocks.

Common triggers include:

- Approval of new medicines.

- Vaccine developments.

- Health emergencies.

- Research results.

Public health news spreads fast, and investors react quickly.

Energy Stocks in Focus

Energy stocks trend when oil prices rise or global events affect supply.

Many investors search for energy companies during times of uncertainty.

This search growth often highlights Top Stocks in oil, gas, or renewable energy.

For example:

- Oil production cuts.

- Clean energy investments.

- Rising fuel prices.

- Government energy policies.

Energy remains a key sector for trending market opportunities.

Consumer Brands That Capture Public Buzz

Popular consumer brands can become Top Stocks when they release new products or expand globally.

People love to search for brands they use daily. That search behavior often increases when sales grow.

Strong consumer companies trend due to:

- Holiday shopping seasons.

- Viral marketing campaigns.

- Expansion into new markets.

- Strong quarterly earnings.

Consumer demand plays a big role in stock performance.

Financial Institutions on the Radar

Banks and financial firms gain attention during rate changes and economic shifts.

When interest rates rise, many investors search for banking stocks.

This increased attention can turn major banks into Top Stocks for income-focused investors.

Search interest often spikes due to:

- Central bank decisions.

- Economic reports.

- Loan growth updates.

- Dividend announcements.

Financial stocks can be stable choices during uncertain times.

Growth vs. Stability: Finding Balance

Some investors prefer fast-growing companies. Others prefer stable, steady performers.

Search data helps reveal which type is currently popular.

Growth stocks often appear among Top Stocks when the economy is strong. Stable companies trend more during uncertain times.

Here is a simple comparison:

Growth Stocks

- Higher risk.

- Faster revenue increases.

- More price swings.

Stable Stocks

- Lower risk.

- Consistent earnings.

- Regular dividends.

Understanding this balance helps investors make better choices.

Best Stock Picks Based on Search Momentum

When looking at Best Stock Picks, search momentum is a powerful tool. It shows which companies are gaining attention before price jumps.

Many analysts now combine search data with financial reports. This method gives a broader view of potential Top Stocks.

To use search momentum wisely:

- Track weekly search spikes.

- Compare interest with earnings data.

- Avoid hype without strong fundamentals.

- Look for consistent growth in searches.

Search trends alone are not enough. They work best when paired with solid research.

Risks of Following Search Trends

Not every trending company becomes a long-term winner.

Sometimes, people search for stocks due to rumors or negative news.

This can cause quick price jumps followed by sharp drops. That is why careful study is needed before choosing Best Stock Picks.

Keep these risks in mind:

- Sudden hype can fade.

- Market rumors spread quickly.

- High volatility can cause losses.

- Emotional decisions can hurt returns.

Smart investors stay calm and focus on long-term value.

Tools to Track Trending Stocks

Many platforms now offer tools to track trending stocks. These tools analyze search volume, social media mentions, and news coverage.

By using these tools, investors can spot early signals of Top Stocks.

Popular tracking methods include:

- Search trend reports.

- Market news alerts.

- Stock screening platforms.

- Trading volume analysis.

Combining multiple tools increases accuracy.

Long-Term Strategy for Market Success

While trending stocks can offer short-term gains, long-term investing builds real wealth.

Search data should guide research, not replace it.

Many successful investors use search trends to find ideas. Then they study earnings, debt levels, and growth plans before investing in Top Stocks.

Here are simple steps for long-term success:

- Diversify across sectors.

- Avoid investing based on hype alone.

- Review company fundamentals.

- Think in years, not days.

Patience often leads to stronger results.

Final Thoughts

Finding Top Stocks through search data is an exciting way to understand market behavior. It shows what people care about and where attention is growing.

However, smart investing requires more than popularity. The true Best Stock Picks combine strong fundamentals with rising public interest.

By watching trends, studying company reports, and managing risk, investors can uncover strong opportunities. Use search data as a helpful guide, but always invest with a clear plan and long-term vision.

ASX 200 Surges in Early Trading – Peoples Search Trends Indicate Market Breakout

The ASX 200 surges in early trading as investor interest spikes. Should I invest after ASX 200 surge? Explore market trends, risks, breakout signals, and smart investment strategies.

The ASX 200 surges in early trading have caught the attention of investors across Australia and beyond.

Many people are now asking, “Should I invest after ASX 200 surge?” as online search trends show rising interest in the stock market and possible breakout signals.

When the ASX 200 surges, it often sparks excitement and fear at the same time. Some see opportunity, while others worry the market may fall back just as fast.

In this article, we break down what the recent ASX 200 surges mean, why people are searching for answers, and how you can decide your next move with confidence.

What Is Happening in Early Trading?

The ASX 200 surges were seen right after the market opened. Shares climbed quickly, and many sectors moved higher together.

Early trading is often driven by overnight global news. Strong leads from the US and Asia helped push Australian shares up.

Traders reacted fast. Buying pressure increased within minutes of the opening bell.

This kind of movement can signal strong investor confidence. It can also show that large institutions are entering the market.

Why the ASX 200 Surges Matter

When the ASX 200 surges, it reflects overall strength in Australia’s top 200 listed companies. These include banks, mining firms, and retail giants.

A sharp rise can signal:

- Growing economic confidence

- Positive company earnings

- Strong global market support

- Increased foreign investment

Investors often view such moves as a sign of momentum. Momentum can attract even more buyers.

However, sharp moves also raise caution. Fast gains can sometimes lead to quick pullbacks.

Search Trends Show Rising Investor Interest

Online searches for terms like “ASX 200 breakout,” “ASX 200 forecast,” and “Should I invest after ASX 200 surge?” have increased.

This shows that everyday investors are paying attention. When search interest rises, it often matches strong market moves.

Retail investors want clarity. They are looking for simple answers about risk and reward.

This rise in search activity suggests that the recent ASX 200 surges are not going unnoticed. It may signal a shift in market sentiment.

Key Sectors Driving the Rally

Not all stocks rise equally when the ASX 200 surges. Some sectors lead the way.

Recently, the following sectors helped push the index higher:

- Banking and financial services

- Mining and resources

- Technology shares

- Energy companies

Banks gained due to strong earnings updates. Mining stocks benefited from rising commodity prices.

Technology shares often jump when global markets perform well. Energy stocks move higher when oil prices increase.

These combined gains created upward pressure on the entire index.

Global Markets and Their Influence

The Australian market does not move alone. When Wall Street rises, the ASX 200 often follows.

Recent gains in US stock markets gave local investors confidence. Strong economic data from overseas also helped.

Positive global signals can:

- Encourage foreign investment

- Improve local business confidence

- Strengthen the Australian dollar

- Support commodity prices

All these factors can help explain why the ASX 200 surges in early trading.

Is This a Market Breakout?

A breakout happens when the market moves above a key resistance level. Traders watch these levels closely.

When the ASX 200 surges past previous highs, it can signal a new upward trend. This attracts technical traders who follow chart patterns.

But not every surge means a long-term rally. Sometimes, markets test new highs and then pull back.

Investors should watch trading volume. High volume often confirms a true breakout.

Should I invest after ASX 200 surge?

This is the big question many investors are asking: Should I invest after ASX 200 surge?

There is no simple yes or no answer. It depends on your goals, timeline, and risk tolerance.

Before investing, consider:

- Are you investing for the long term?

- Can you handle short-term price swings?

- Are you buying strong companies or just chasing momentum?

- Do you have a diversified portfolio?

If the ASX 200 surges and you invest without a plan, you may face stress if prices drop.

Long-term investors often focus on fundamentals rather than short-term spikes. They may invest gradually instead of all at once.

So when asking, Should I invest after ASX 200 surge?, think about strategy, not just excitement.

Risks Behind Rapid Market Gains

While the ASX 200 surges can feel positive, risks always remain.

Markets can fall due to:

- Unexpected economic news

- Interest rate changes

- Global political tensions

- Company profit warnings

Rapid gains sometimes lead to profit-taking. Investors who bought earlier may decide to sell.

This selling pressure can slow or reverse gains. That is why risk management is important.

Setting stop-loss levels and diversifying investments can help reduce risk.

Long-Term vs Short-Term Thinking

When the ASX 200 surges, short-term traders often act quickly. They aim to profit from small price moves.

Long-term investors take a different approach. They look at economic growth, company strength, and dividends.

If you are thinking, Should I invest after ASX 200 surge?, ask yourself how long you plan to stay invested.

Short-term investing requires close monitoring. Long-term investing requires patience.

History shows that markets tend to grow over time. However, short-term swings are common.

How Retail Investors Are Reacting

Retail investors are more active than ever. Easy-to-use trading apps make investing simple.

When the ASX 200 surges, many first-time investors enter the market. They do not want to miss out.

Social media also plays a role. Positive posts can increase buying activity.

But emotional decisions can lead to mistakes. Fear of missing out often drives rushed investments.

Smart investors stay calm. They research before acting.

Smart Steps Before You Invest

Before making a move after the ASX 200 surges, take practical steps.

Here are simple actions you can follow:

- Review your financial goals

- Check your emergency savings

- Study company earnings reports

- Spread investments across sectors

- Avoid investing money you may need soon

These steps can protect you from sudden market changes.

If you are still wondering, Should I invest after ASX 200 surge?, consider speaking with a licensed financial adviser.

Professional advice can match investments to your personal situation.

What History Tells Us About Market Surges

Past ASX 200 surges have often been followed by continued growth. But there have also been pullbacks.

Markets move in cycles. Booms are followed by corrections.

For example, after strong rallies in previous years, short dips occurred before new highs were reached.

This shows that patience matters. Quick reactions are not always rewarded.

Understanding history can help answer the question, Should I invest after ASX 200 surge?

Final Thoughts

The recent ASX 200 surges in early trading have sparked excitement and rising online searches. Investors are clearly focused on the market’s direction.

Strong global support, sector gains, and technical breakouts have helped fuel the rally. Yet risks remain, and rapid gains can reverse.

If you are asking, Should I invest after ASX 200 surge?, take time to review your financial goals and risk comfort. Investing should be based on strategy, not emotion.

The ASX 200 surges may signal opportunity, but smart decisions come from research and planning. Stay informed, stay calm, and invest wisely for the long term.

IN Stock Market Update 2026: Top Gainers, Losers & Expert Predictions

India Stock Market Update 2026 with top gainers, losers, sector trends, Sensex outlook, and expert predictions for smart investing decisions.

The India Stock Market Update for 2026 has caught the attention of investors across the country. From strong rallies in tech shares to sudden drops in energy stocks, this year has been full of surprises.

In this detailed IN Stock Market Update, we break down the top gainers, biggest losers, and what experts are predicting next. If you are planning to invest or already tracking the market, this guide will help you understand the current situation in simple terms.

Market Overview: How 2026 Started

The year 2026 began on a positive note. Major indices like the Sensex and Nifty 50 saw steady growth in the first quarter.

Strong domestic demand and stable global cues supported the rise. Many retail investors entered the market, adding fresh liquidity.

This India Stock Market Update shows that confidence remained high during the early months. However, mid-year volatility reminded investors that markets can change quickly.

Key Factors Driving Market Movement

Several factors shaped the IN Stock Market Update in 2026. Some were local, while others came from global events.

Main drivers included:

- Interest rate decisions by the Reserve Bank of India

- Global crude oil price changes

- Strong earnings from banking and IT sectors

- Government spending on infrastructure

- Foreign investor activity

Each of these factors influenced stock prices in different ways. When interest rates remained stable, banking stocks performed better.

Top Gainers of 2026 So Far

This year, some companies delivered excellent returns. These stocks became the highlight of every India Stock Market Update.

Top performing sectors include:

- Information Technology

- Renewable Energy

- Banking and Financial Services

- Infrastructure and Capital Goods

For example, leading IT firms gained due to strong global contracts. Renewable energy companies also rose as green policies expanded.

Investors who entered these sectors early enjoyed solid profits. Many analysts believe this growth trend may continue if earnings remain strong.

Biggest Losers and Market Corrections

Not all sectors performed well. The IN Stock Market Update also shows areas of weakness.

Sectors that struggled include:

- Traditional energy companies

- Some mid-cap real estate firms

- Export-heavy manufacturing businesses

High raw material costs and global slowdown fears affected these stocks. As a result, some shares corrected sharply.

Market corrections are normal. They help remove overpricing and bring balance back to valuations.

Performance of Sensex and Nifty 50

The Sensex crossed new levels in early 2026. The Nifty 50 followed closely with steady gains.

This India Stock Market Update reveals that both indices benefited from strong banking stocks. Private banks reported higher profits, which boosted index performance.

However, global uncertainty caused short-term dips. Despite this, long-term momentum remains positive.

Sector-Wise Breakdown

A closer look at sector performance gives a clearer picture.

Banking Sector

- Strong loan growth

- Better asset quality

- Stable interest margins

IT Sector

- Growth in digital projects

- Rising global demand

- Currency benefits

Pharma Sector

- Stable but moderate growth

- Export support

Energy Sector

- Pressure due to global price swings

This detailed IN Stock Market Update shows how sector rotation played a big role in 2026.

Role of Retail and Foreign Investors

Retail investors have become powerful players in the market. Monthly investment through systematic plans remained strong.

Foreign Institutional Investors (FIIs) also influenced trends. When they bought heavily, markets moved up. When they sold, volatility increased.

In this India Stock Market Update, it is clear that investor sentiment drives short-term movement. Long-term growth, however, depends on company earnings.

Government Policies and Economic Growth

Government reforms supported economic expansion. Infrastructure spending created jobs and improved business activity.

Tax benefits for startups and production-linked incentives helped many industries grow. These measures positively impacted the IN Stock Market Update.

When the economy grows steadily, companies earn more. This pushes stock prices higher over time.

Expert Predictions for the Rest of 2026

Market experts remain cautiously optimistic. Many analysts expect moderate growth in the coming months.

Key predictions include:

- Banking and finance may stay strong

- IT could benefit from global recovery

- Renewable energy may attract more investors

- Volatility may continue before major global events

Experts suggest focusing on quality stocks instead of short-term trading. This advice is often repeated in every India Stock Market Update discussion.

Risks Investors Should Watch

Every investment carries risk. The IN Stock Market Update also highlights possible challenges.

Major risks include:

- Global recession fears

- Sudden crude oil price spikes

- Inflation pressure

- Geopolitical tensions

If these risks rise, markets could face corrections. Investors are advised to stay diversified.

Smart Investment Strategies in 2026

Investing wisely is more important than timing the market. This year requires patience and discipline.

Simple strategies include:

- Invest regularly instead of lump sum

- Diversify across sectors

- Focus on companies with strong profits

- Avoid panic selling during dips

This India Stock Market Update suggests that long-term investors may benefit more than short-term traders.

Mid-Cap and Small-Cap Trends

Mid-cap and small-cap stocks showed mixed performance. Some delivered high returns, while others corrected sharply.

High growth companies in technology and manufacturing outperformed. But weaker balance sheets struggled during volatile phases.

The IN Stock Market Update indicates that careful stock selection is necessary in this segment.

Impact of Global Markets

Global markets strongly affect India’s stock movement. When US and European markets rise, Indian stocks often follow.

In 2026, global inflation trends and policy decisions played a major role. This India Stock Market Update reflects how connected markets have become.

Investors should monitor global cues regularly. Ignoring them may lead to unexpected surprises.

Final Thoughts

The India Stock Market Update for 2026 shows a year filled with opportunity and caution. Strong sectors like banking, IT, and renewable energy led the rally, while traditional energy and export-heavy businesses faced pressure.

Overall, the IN Stock Market Update suggests steady long-term growth, supported by economic reforms and strong domestic demand. Still, short-term volatility remains possible due to global risks.

If you are investing in 2026, focus on quality companies, diversify wisely, and think long term. Keep tracking every India Stock Market Update to stay informed and make smarter decisions.

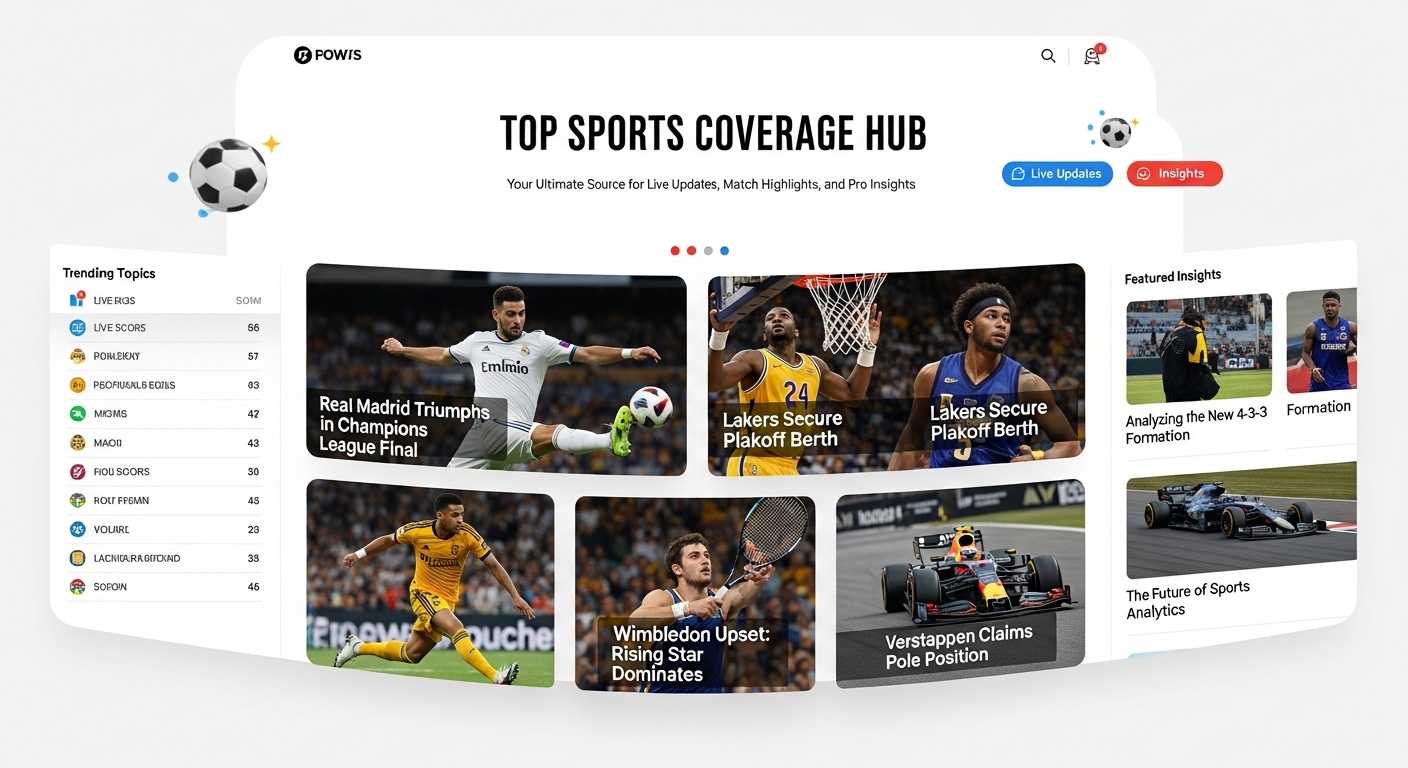

Top Sports Coverage Hub for Live Updates, Match Highlights and Pro Insights

If you are looking for the Best Sports Coverage, you want more than just scores. You want fast updates, clear highlights, and expert views that help you understand the game.

Top Sports Coverage gives fans a single place to follow matches, track teams, and enjoy every big moment. It keeps you close to the action, whether you are at home, at work, or on the move.

If you are looking for the Best Sports Coverage, you want more than just scores. You want fast updates, clear highlights, and expert views that help you understand the game.

Top Sports Coverage gives fans a single place to follow matches, track teams, and enjoy every big moment. It keeps you close to the action, whether you are at home, at work, or on the move.

Why Fans Need a Reliable Sports Source?

Sports move fast, and news changes in seconds. A trusted platform makes sure you never miss a key play.

With Top Sports Coverage, updates are shared quickly and clearly. The focus is on facts, not rumors.

Many fans say the Best Sports Coverage feels like watching the match with a smart friend. You get details that make the game more exciting.

Live Match Updates That Keep You Ahead

Live updates are the heart of any strong sports platform. Fans want to know what is happening right now.

Top Sports Coverage offers:

- Real-time scores

- Ball-by-ball or play-by-play commentary

- Instant injury updates

- Line-up changes before kickoff

- Live stats during the match

These features help fans feel connected to the action. The Best Sports Coverage ensures that every goal, run, or point is reported without delay.

Match Highlights in Simple and Clear Format

Not everyone can watch full matches. That is where highlights become important.

Top Sports Coverage shares short and clear highlight clips. Key moments are explained in simple English so all fans can understand.

For example, if a player scores a winning goal in the final minute, the highlight will show the build-up and the reaction. The Best Sports Coverage also explains why that moment mattered.

Expert Analysis That Makes Sense

After the match ends, fans want answers. Why did one team win? What went wrong for the other side?

Top Sports Coverage includes expert opinions that are easy to follow. Complex tactics are broken down into simple ideas.

You may read about:

- Team strategies

- Player performance reviews

- Key turning points

- Coach decisions

- Future match predictions

The Best Sports Coverage does not confuse readers with hard words. It explains the game in a way that even new fans can enjoy.

Coverage Across Multiple Sports

Different fans love different sports. A true sports hub must cover them all.

Top Sports Coverage often includes:

- Football

- Cricket

- Basketball

- Tennis

- Baseball

- Hockey

- Formula 1

- Mixed martial arts

This wide range makes it easier for fans to stay updated in one place. The Best Sports Coverage brings all major sports under one roof.

Player Interviews and Behind-the-Scenes Stories

Fans love to know what players think and feel. Interviews add a human touch to sports reporting.

Top Sports Coverage shares player reactions after big wins and tough losses. These stories help fans connect with their favorite stars.

Behind-the-scenes content may include:

- Locker room insights

- Training sessions

- Recovery routines

- Personal journeys

The Best Sports Coverage tells stories that go beyond the scoreboard.

Easy-to-Use Design for All Devices

A sports hub should be simple to use. Fans do not want to search for basic information.

Top Sports Coverage platforms are often designed with:

- Clean layout

- Quick-loading pages

- Clear match schedules

- Simple navigation menus

- Mobile-friendly design

This makes it easy to find scores, highlights, and news. The Best Sports Coverage focuses on user comfort as much as content quality.

Real-Time Notifications and Alerts

In today’s world, many fans follow matches through their phones. Alerts play a big role.

Top Sports Coverage sends:

- Goal alerts

- Match start reminders

- Final score updates

- Breaking sports news

- Transfer updates

These alerts save time and keep fans informed. With the Best Sports Coverage, you do not need to refresh the page again and again.

Data, Stats, and Records Made Simple

Numbers tell the true story of a match. Stats help fans compare teams and players.

Top Sports Coverage presents data in a clean and clear way. Charts and short summaries make it easy to understand.

You may find:

- Head-to-head records

- Season performance tables

- Player scoring charts

- Historical achievements

- Ranking updates

The Best Sports Coverage turns complex data into simple insights.

Community Interaction and Fan Opinions

Sports are more fun when fans share their thoughts. A good platform allows healthy discussion.

Top Sports Coverage often includes:

- Comment sections

- Fan polls

- Match predictions

- Social media sharing options

Fans can debate results and celebrate wins together. The Best Sports Coverage builds a strong sports community, not just a news site.

How to Choose the Right Platform for You?

Not all sports websites are the same. Some focus only on scores, while others offer deep insights.

When choosing a sports hub, look for:

- Speed of updates

- Quality of analysis

- Clear highlight videos

- Wide sport coverage

- Honest reporting

Top Sports Coverage stands out when it combines speed, clarity, and expert views. The Best Sports Coverage should feel trustworthy and easy to use.

Benefits of Following a Dedicated Sports Hub

Using a single sports source saves time. You do not need to visit many websites.

With Top Sports Coverage, you can:

- Track your favorite team daily

- Watch quick highlights

- Read match previews

- Stay informed about transfers

- Understand player form

The Best Sports Coverage helps both casual fans and serious followers stay updated without stress.

The Future of Digital Sports Reporting

Sports reporting keeps changing with new technology. Fans now expect more than text updates.

Top Sports Coverage is moving toward:

- AI-powered match summaries

- Personalized content feeds

- Interactive stats tools

- Virtual reality highlights

- Voice-based updates

These tools make sports more engaging. The Best Sports Coverage adapts to new trends while keeping information clear and accurate.

Final Thoughts

Sports bring people together across the world. A strong sports hub helps fans stay close to their favorite teams and players.

Top Sports Coverage offers live updates, clear highlights, expert insights, and simple stats in one place. It makes following sports easy and enjoyable.

If you want fast news, deep analysis, and user-friendly design, choose a trusted platform that delivers the Best Sports Coverage every day. Stay connected, stay informed, and enjoy every moment of the game.